Trending Real Estate Investment in Kenya (2026): Where the Smart Money Is Going

Introduction: Why Kenya Real Estate Still Beats Other Investment Options

Real estate investment Kenya 2026 sector continues to stand out as one of the most resilient and high-growth investment arenas in Africa. With urbanization rates climbing, infrastructure expanding, and diaspora capital flowing in, property in Kenya remains a top choice for investors seeking steady rental income, capital appreciation, and portfolio diversification.

In this blog, we explore the top investment trends shaping Kenya’s real estate landscape in 2026 — backed by data and expert insights.

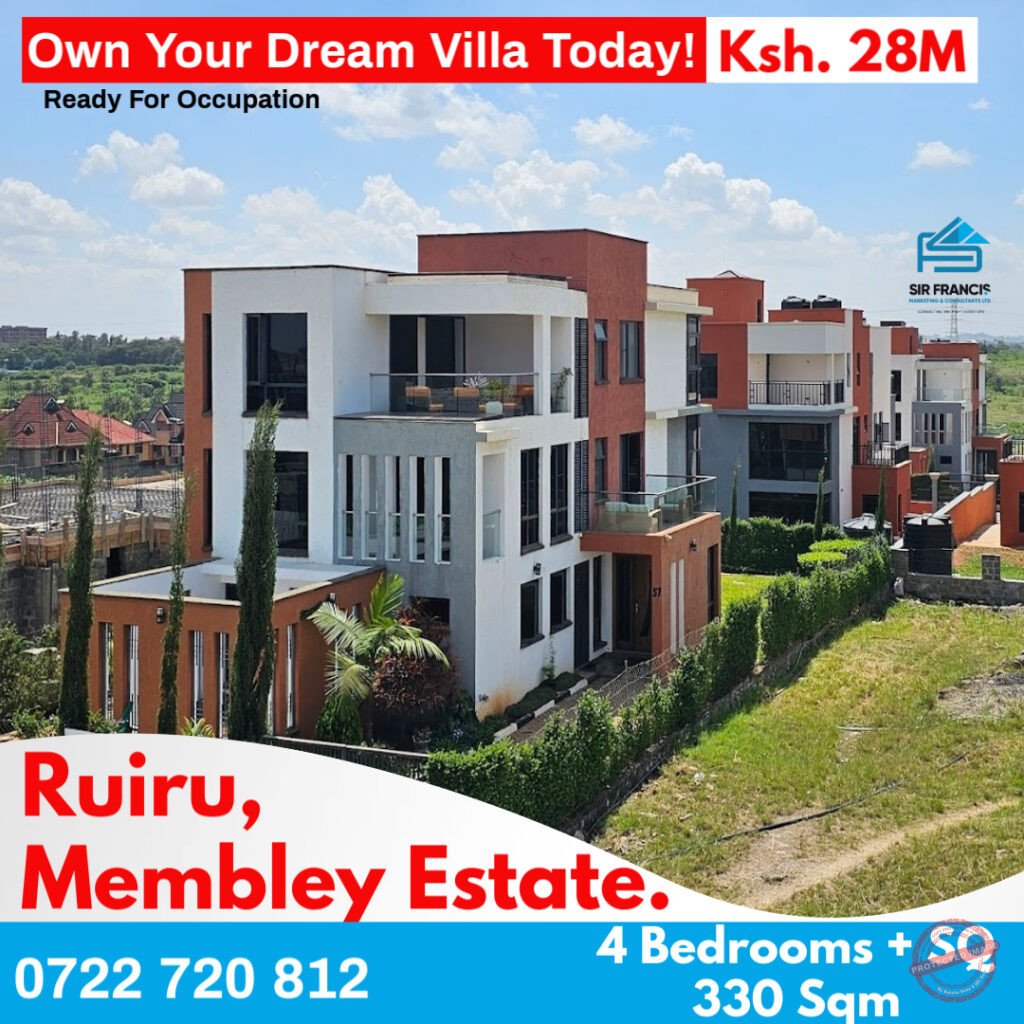

1. Satellite Towns: The New Gold Mines for Real Estate Investors

Firstly, urban sprawl from Nairobi has fueled rapid growth in surrounding satellite towns, which are now hotbeds for property value appreciation. Key areas include:

- Kitengela

- Ruiru

- Syokimau

- Athi River

- Ngong

- Ongata Rongai

Moreover, these towns offer lower entry prices, high rental yields, and better land availability. Infrastructure improvements, such as commuter rail and highways, are accelerating growth.

Investor Tip: Buy land or residential units near major transport corridors now, because capital growth is expected as infrastructure expands.

2. Affordable Housing: High Demand Meets Government Support

In addition, affordable housing remains a cornerstone of Kenya’s property growth story. With initiatives like the Affordable Housing Program (AHP) and public–private partnerships, demand continues to grow among middle-income earners.

Key investment angles include:

- Build-to-rent developments targeting young professionals

- Affordable apartments and maisonettes in commuter towns

- Mixed-income housing developments combining commercial and residential use

Consequently, this segment continues to record strong demand even when luxury property growth slows down.

3. Mixed-Use Developments: Live, Work & Play

Another significant trend is mixed-use developments (MUDs), which integrate residential, retail, office, and leisure spaces. Areas like Westlands, Kilimani, and Karen are seeing a surge in such developments.

Why investors love MUDs:

- They attract tenants seeking convenience

- They provide higher long-term rental yields

- Property value appreciates due to lifestyle appeal

In short, mixed-use developments are reshaping urban living in Kenya.

4. Diaspora Investment: Capital from Afar

Meanwhile, Kenyan nationals living abroad are significantly impacting real estate demand through remittances and property purchases. Real estate investment Kenya 2026 With better digital tools and secure platforms, diaspora buyers now invest with greater confidence.

Typical investments include:

- Family homes in gated communities

- Land parcels for future development

- Rental units in high-demand hubs

As a result, diaspora capital continues to enhance liquidity in the market.

5. Coastal & Secondary Urban Markets: Opportunities Beyond Nairobi

While Nairobi remains central, coastal towns such as Mombasa, Nyali, Diani, Kilifi, and urban centres like Nakuru are attracting investors.

Reasons to consider these markets:

- Strong tourism and lifestyle appeal

- Growing infrastructure development

- Ideal for vacation properties and short-lets

Therefore, these regions provide excellent diversification for property portfolios.

6. Rental Market Stabilization & Niche Opportunities

Furthermore, Real estate investment Kenya 2026 rental market is stabilizing, offering niche opportunities such as:

- Student accommodation near universities

- Secure gated estates with modern amenities

- One- and two-bedroom apartments for young professionals

This stabilization ensures higher yields for certain property types compared to long-term traditional leases.

7. Technology: Transforming Property Transactions

Finally, technology is transforming how property is marketed and purchased:

- Online property listings and virtual tours

- AI-driven property discovery tools

- Mobile money deposits and seamless reservations

As a result, property investment is now more transparent, accessible, and faster, particularly for international buyers.

Final Thoughts: Smart Investing in Kenya’s Property Market

Kenya’s real estate market in 2026 remains dynamic and rewarding. For maximum returns:

- Focus on growth corridors with infrastructure potential

- Diversify across residential, rental, and mixed-use assets

- Leverage technology and professional guidance

Ultimately, Kenya’s property investments continue to offer one of the best risk-reward profiles in Africa.

Ready to Invest in Kenya Real Estate?

Whether you’re exploring prime investment properties or need professional marketing support to sell your listings faster, Sir Francis Marketing Ltd is here to help you succeed.

👉 Visit: https://sirfrancismarketingltd.co.ke

👉 Let us elevate your property visibility and attract qualified buyers.